“Annndd it's gone” - the South Park Bank teller

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

BACKGROUND.

Today’s newsletter is a one-off. A more comprehensive write-up (much too large for email) is saved here; & the backup files are saved here (& a there’s pod for Unhedged users) -

Recently, we’d had couple non-E&P friends in bank risk departments finding themselves looking at RBLs - for the 1st time - specifically asking questions about reserves

A Sunday Twitter discussion spurred us to make a case study – we’d previously analyzed the subject company (Ring) & had the software / data to do a quick turn-around on the wells

PRODUCTION FORECASTS.

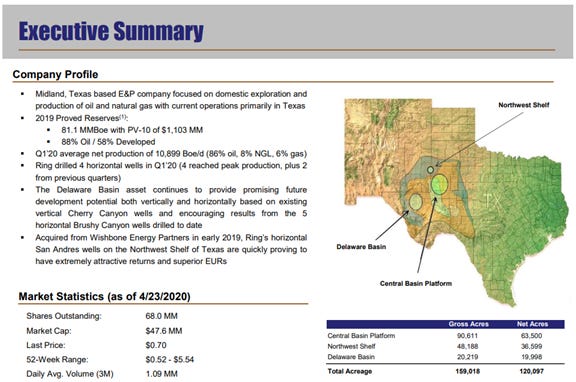

In 2019, Ring Energy (a US E&P) acquired Northwest Shelf assets from Wishbone, roughly doubling its proved reserves & production.

What we care about - today - is:

How Ring financed that transaction; &

The value of the underlying assets securing the loan

The $291M purchase price was funded with $264M in cash provided by a reserve based lending facility (RBL).

A couple years back, we’d looked at Ring - from the perspective of an equity investor:

On it’s surface, it had a nice coat of paint

But under the hood, it was ugly

A recent conversation dug up some memories:

With Ring, there were 2x issues (that we were aware of):

Historical public data submitted to state regulators did not empirically support the company’s production forecast; &

The inputs from their investor presentations / PRs could not mathematically by used as the inputs in a DCA formula and produces their claimed outputs (prod forecasts)

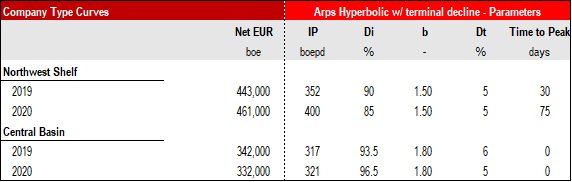

The company was forecasting something like this:

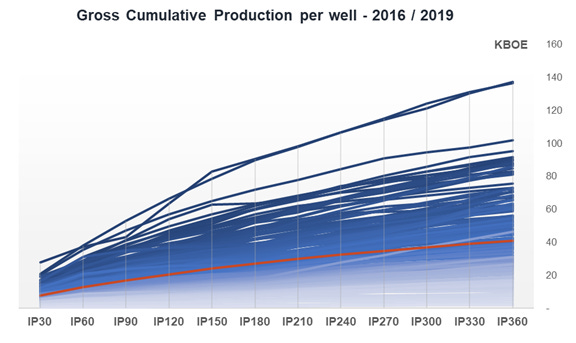

We ran a production forecast based on 2x third-party data providers (in particular, thanks to Enno at ShaleProfile for the data & visualizations), covering all of their 200 horizontal wells.

We created an individual well forecast for each horizontal well - the outcome was clear.

Out of 192 horizontal wells analyzed:

Average IP30 ranging from 220boepd to 270 boepd

Average IP360 consistently under 150 kboe (blue curves hereafter)

On average from 2016 to 2019 the IP360 reaches 40-45 kboe (red curve hereafter)

Now - armed with this historical data - it’s not too hard to extrapolate what EURs would look like, using traditional decline models (Arps hyperbolic, etc.).

The gross EUR for these wells averaged 111 kboe (Qi/IP30: 247 boepd, Di: 77%, Dt: 5%, b: 0.7).

All of this begs the question - how do you reconcile our 110kboe gross EUR from the Ring’s announced 400+ kboe net EUR?

The short answer: someone broke the math.

[see pages 8-10 in the completed write-up file]

SEC PV10.

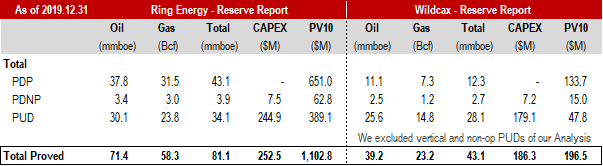

With the information that was available, we replicated Ring’s 2019 reserve report & estimated their PV10.

We did our own reserve valuation as of Jan 2020, based on public historical production data from all their wells (190+ horizontal wells, 600+ vertical wells).

We also forecasted their entire horizontal proved well inventory.

While - giving Ring the benefit of doubt w/ generous assumptions - we got these results:

Assumptions:

With production from every well they own

With Ring’s type curve parameters (with math reconciled)

Their full cost assumptions

Their full drilling inventory (ex. Non-operating & verticals)

The same pricing

We ended up with 1/5 of their published PV10 values.

On to where it matters – Ring’s RBL -

THE RBL.

Since we’ve already calc’d every individual well decline, we figured (the ex-RBL banker authors of this case study) that it would be amusing to review Ring’s Spring borrowing base redetermination situation & reminisce a little about the past (flashback those Nigerian RBLs in 2015… oh, the memories)…

[Click here for the full assumptions / type curves & here for the model]

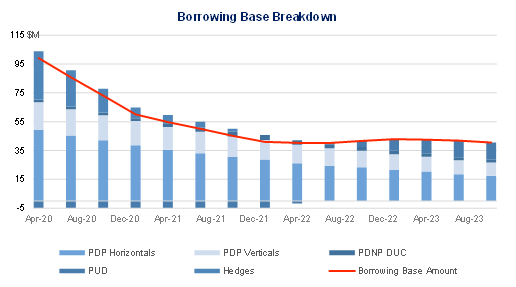

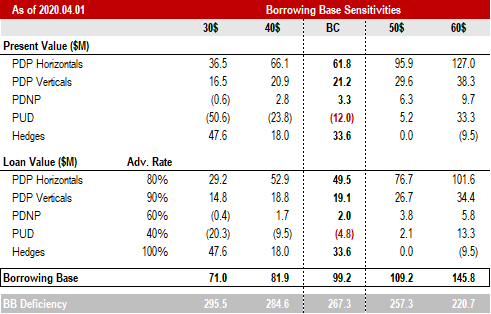

The output isn’t pretty:

At yr end, Ring had ~$370MM drawn on their credit facility.

We believe Ring’s borrowing base - empirically - should be $100MM in May and $86MM in November.

At $60/bbl oil, Ring would still have a borrowing base deficiency of >$200MM…

… so something’s gotta give -

BORROWING BASE DEFICIENCY.

At yr end, Ring had $10MM in cash on hand.

Facing a large deficiency, they’re probably doing everything in their power to raise more cash.

Actions like:

Selling acreage

Not / slow paying bills (feels like most of America is)

And raising capital via any / all securities offerings

Regarding that last point - on Monday, Ring filed a mixed shelf.

To us, that signals that the borrowing base redetermination process is a serious, near-term liquidity risk -

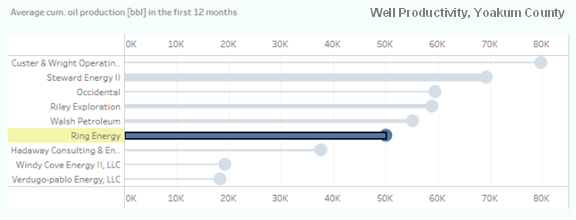

Ring’s NWS acreage lags behind their peer; thanks again to Enno at ShaleProfile for the data & visualizations

THE BANKS.

Ring’s lenders don’t want to be in this situation either…

There’s no junior lenders, so they’ll likely be relatively more flexible on the RBL redetermination process

But… there will likely be more flexibility, if Ring executes a securities offering

That said - now, or later - Ring has to come up with a substantial amount cash to pay down that borrowing base deficiency.

And we just don’t see how they’ll be able to generate that cash, from operations or asset sales -

FINAL THOUGHTS.

The reason we did this analysis is not to show that Ring is about to be in a single-car-wreck:

Ring’s share price has decline by ~95% since we first took a look in 2018

And yeah, a big part of the problem is oil prices

Right now, Ring is that car that just wrecked on I-10, and there’s about to be a 20-car pile-up, starting with its RBL syndicate.

To be clear - we don’t hold any positions in Ring’s securities (long or short) – and we will not establish positions in them for the foreseeable future (by foreseeable, we mean months – but, realistically never).

We’re not short sellers.

We’re just saying that if you’re going to take a long position (equity or credit) backed by production - do the work yourself.

Or, hire someone with the right incentives to do the proper diligence.

Finally – as always in A&D - there’s a winner & a loser.

Congrats Wishbone – selling was, without a doubt, the right move -

That’s it for this week - we’ll be back to our regularly scheduled programming on Tuesday - UFC this weekend -> Gaethje vs Ferguson, we’ll take rec’s for bets, so send any our way -

Can you share who the other 3rd party data provider is?