The Game Theory of a Price Collapse

“This is a triple-whammy: you have oil, you have geopolitics, and you have the virus. And of course, it starts with the virus” Daniel Yergin [yesterday]

***Editor’s note: if you find this newsletter helpful, forward it to friend or colleague***

MACRO.

Books will be written about the insanity of the last four days.

Two events drove the madness:

Russia v Saudi, aka The end of OPEC+

The coronavirus

The events are compounding:

The 1st increases (oil) supply

The 2nd decreases demand

We’ll start with the events that Russia set in place -

FRIDAY.

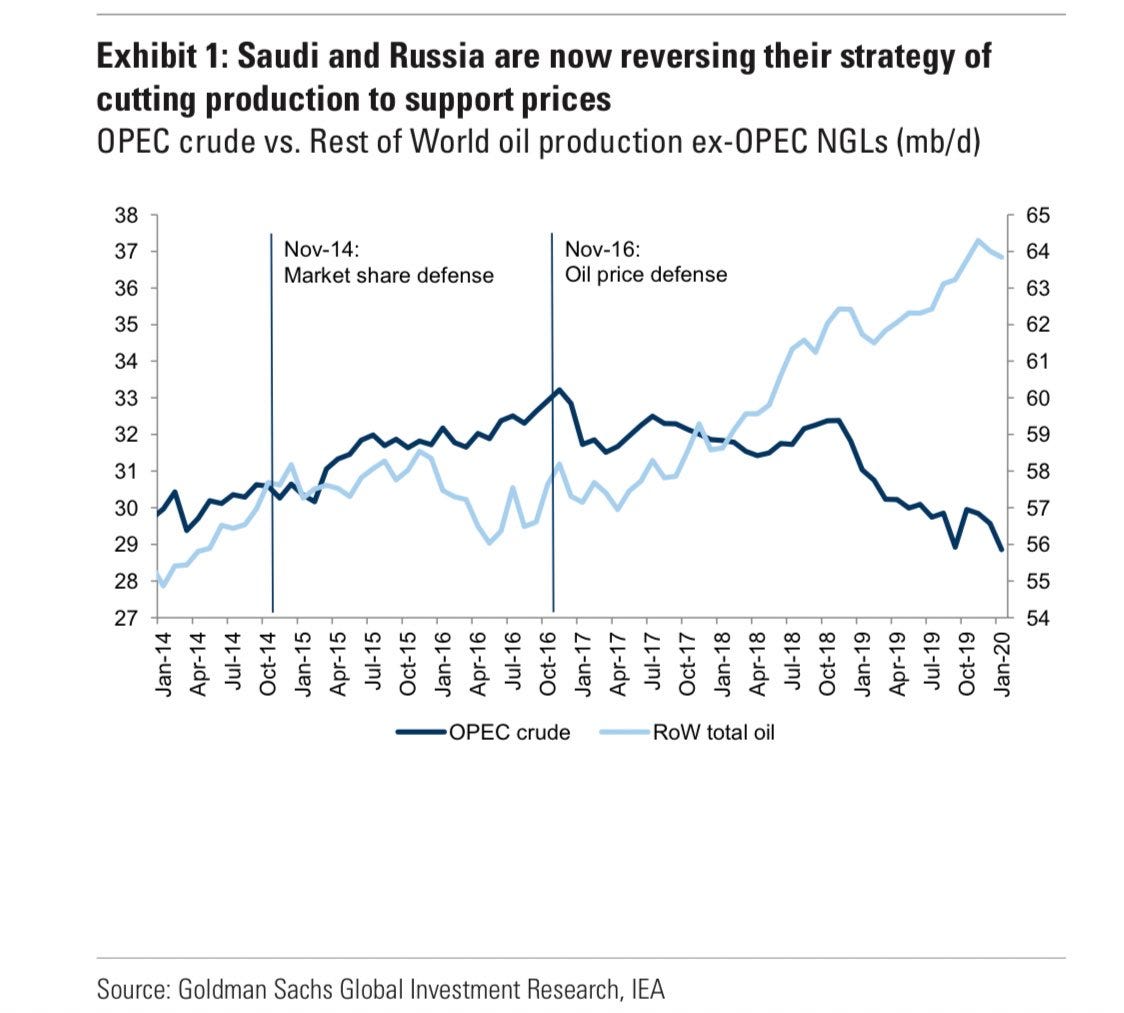

On Friday morning, Russia dramatically ended the OPEC+ cartel.

In the words of the Russian Energy Minister:

“From April 1 neither OPEC nor non-OPEC have restrictions,” Alexander Novak

The purpose of a cartel is to maintain prices at a high level & restrict competition.

Novak’s statement - in effect - ended the cartel.

The reasoning behind the decision had nothing to do with short-term economics - it was geopolitical:

“Let’s see how American shale exploration feels under these conditions” - Rosneft spokesman Mikhail Leontiev

But the market didn’t see it coming - crude prices promptly dropped 10%.

As for the other cartel members, they too were blindsided…

And their responses to the breakup ranged from optimistic delusion to vengeance -

SATURDAY.

Saturday morning, the Crown-Prince of Saudi Arabia, Mohammed bin Salman (MbS), emerged with guns in both hands.

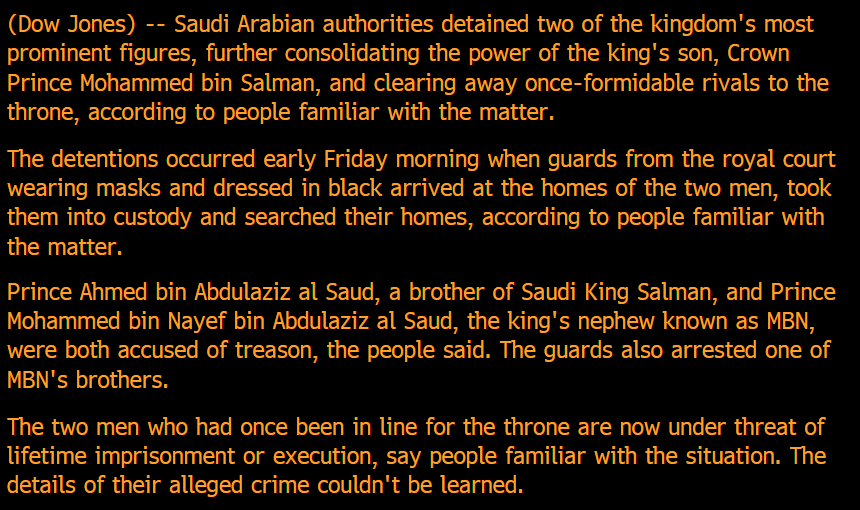

The first pistol was pointed at dissidents, including his family:

The second hand-cannon was pointed at Russia - firing back rumors, including a Saudi production hike of up to 12MM/bbl per day.

What happened, & why it happened:

Many market participants incorrectly diagnosed the situation as classic game theoretical problem - a simple prisoner’s dilemma.

This was not the case:

Russian best interests are political in nature

Saudi’s are economic

Until their interests are aligned, there is no common best interest for them cooperate towards.

MbS is sharp. Machiavellian.

Tyrion Lannister is advising him… figuratively.

MbS’s response to dramatically increase oil production was designed to force so much pain on Russia, that Russian economic interests would supersede their political interests.

The collateral damage from this move was immediate:

[Middle East stock markets open on Saturday night, US time]

Kuwait’s stock market hit it’s stop limit

SUNDAY.

Early afternoon, one rumor dominated:

That Mark Fisher thought that WTI futures would open at $32

A few hours after that, $32 was forgotten…

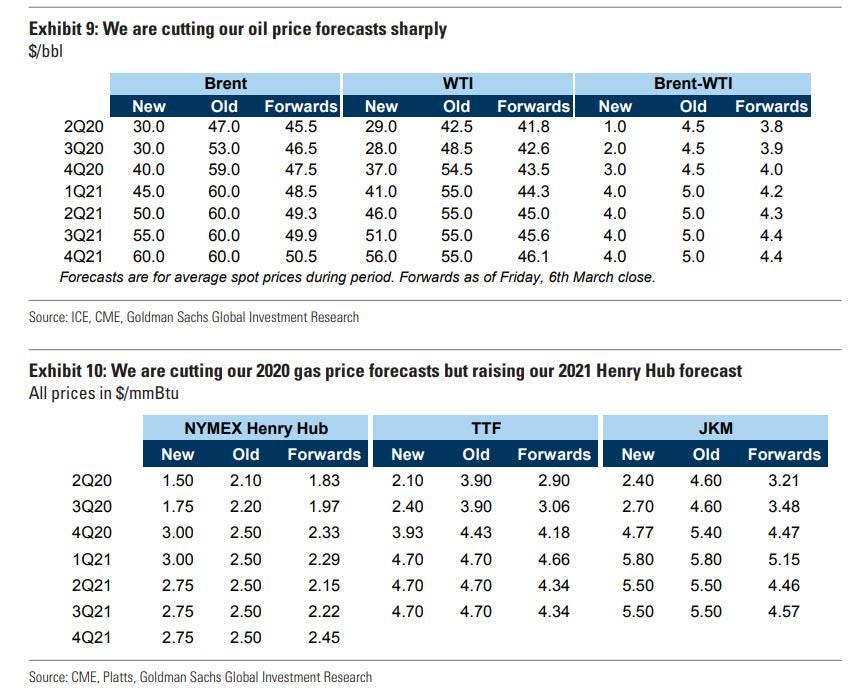

Goldman Sachs put out their updated oil price forecast:

A Q2 base-case for WTI at $29 (Exhibit 9, above)

Traders braced for impact.

Within the first hours of trading, WTI futures dropped below $27 -

MONDAY.

Just minutes before US markets opened, Bloomberg reported the Rosneft (Russia by proxy) response to Saudi:

“Rosneft had prepared for any scenario and would be able to withstand the current plunge in oil prices. Asked how rapidly Rosneft could increase production, the person said analysts who estimate the company could boost output by 300,000 barrels a day within a week or two are well informed” - Bloomberg

This statement had 2x purposes:

To reiterate to Saudi that it’s not about economics; &

To inflict maximum pain on US shale

US markets opened in free-fall.

Within minutes, the 1st circuit breaker was breached, and equity markets were halted.

WTI settled in the low $30s.

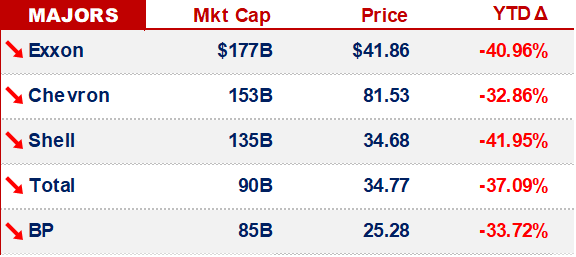

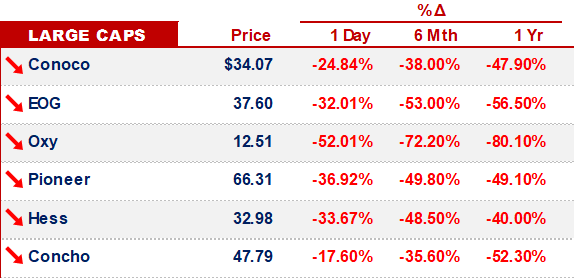

And US E&Ps were crushed -

THE VIRUS.

On Saturday, Italy put 14x northern provinces under quarantine April 3rd

On Monday night, all of Italy was put on lock-down

The virus is spreading as-fast, if not faster than we forecasted in our model.

READ THESE LINKS:

This is a summary of what to expect from the American Hospital Association.

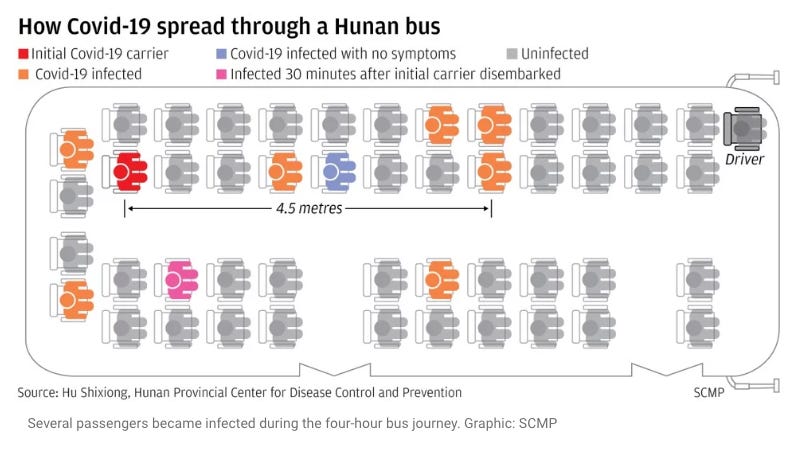

The below graphic illustrates how easily the virus can spread:

FINAL THOUGHTS.

Be financially proactive

We expect that a few companies are going to need to be renamed come July… to put some color on it, think:

LiveNation -> DeadNation

Booking -> Refunding

Lyft -> Drop

Most E&Ps have no material strategic option here - they are at the whim of Russian & Saudi policy

We expect both issues (the virus & oil markets) to get worse before they get better, and we don’t think the equity markets have priced that in

Among other motivations, Russia & Saudi both want to increase market share. To get that, other producers must permanently disappear:

We’re not saying that they are going to get what they want - but it’s prudent to plan for it, and hedge accordingly -

That’s it for today - hopefully the week will surprise us - see you Friday -