Chesapeake Ch.11

“…there was a difference of opinion between [Arthur] Andersen & the Company as to whether the Company [Chesapeake] would be able to continue to operate as a going concern considering its capitalization & financial resource…” - 1993, from a disclosure in Chesapeake’s 1st 10K (PDF p.20)

EDITOR’S NOTE:

In June of ‘92, as Chesapeake was preparing to go public, their auditor - Arthur Andersen - resigned, stating that they did not believe that Chesapeake “would be able to continue to operate as a going concern”.

In a case of irony (that fits like a glove for 2020), Arthur Andersen is infamously known for Not Issuing that statement, back when they were Enron’s auditor…

***If you enjoy this newsletter, do us a favor - send it to a friend or colleague***

Chesapeake Filing Links:

Chesapeake RSA link; Form 8K & Exhibits

Ch.11 Case Files; Case No. 20-33233

Notes:

Equity is a zero

$7BN of debt is getting wiped

Mgmt was paid $25MM before filing

Twitter Accts:

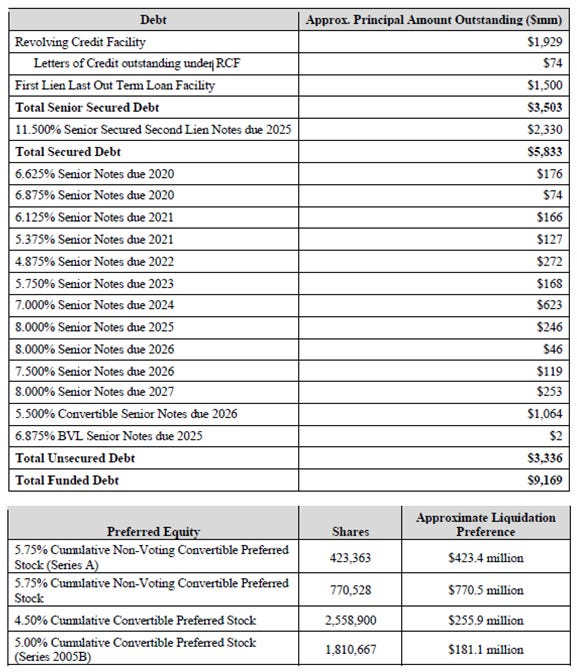

Chesapeake’s Capital Structure - Docket 49 (p.14)

GOING CONCERN.

Even though Chesapeake (finally) filed for Ch.11 on Sunday, Arthur Andersen was - at least at the time - wrong.

Aubrey McClendon took E&P capital raising to new, unexpected heights.

Arthur Andersen did not see that coming.

What John Raymond described as:

“The infinite power of the human mind” - [see EnergyCynic’s header]

… was - in reality - something more like:

“The incredible hustle of Aubrey McClendon”

Act I of Shale was a land-grab.

And that kind of hustle proved to be a powerful tactic -

In business, the strategy of a land-grab is predicated on two outcomes:

Subsequently flipping the acquired “land”; or

Holding said “land”, & it actually having value that yields a profit

The latter is the investment thesis pitched to E&P investors, over the last ~10yrs.

Traditionally, private funds - seeking exposure to “value” - backed E&Ps.

However - flipping (effectively, exposure to an odd form of private mineral price momentum) was the strategy that returned a profit…

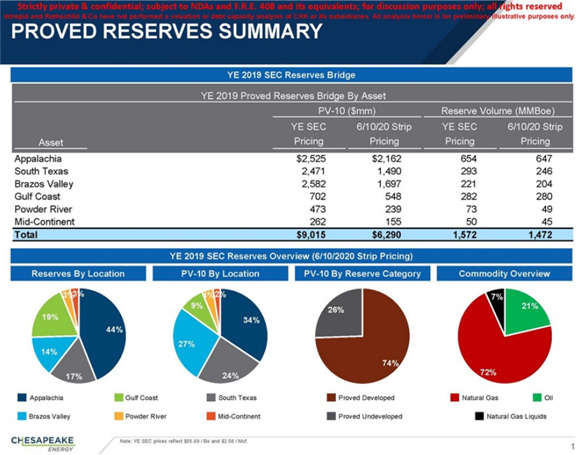

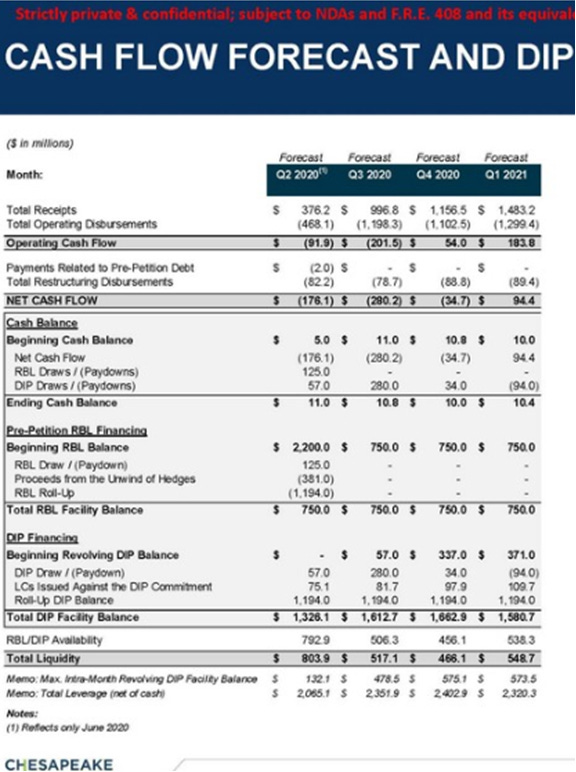

Exhibit 99.2 - DIP Loan Model Forecasts

“Nothing destroys value faster than irrational competitors” - Alfred Lin, Sequoia

If you find yourself going after a land-grab - and the land is worth something - the simple combination of aggressive fundraising & aggressive land acquisition works.

In that case, two tactics can build an empire.

The same two tactics applied to an irrational land-grab can destroy capital faster than the Soviet Ministry of Finance.

At some point before ‘09, the case for Chesapeake’s land-grab probably made sense.

But in Shale’s 2nd Act, the buy-and-hold economics broke.

Even Rolling Stone called them out -

In Mar of ‘12, they wrote a hit piece on Chesapeake, commenting:

“…who profits more from flipping land than drilling for gas”

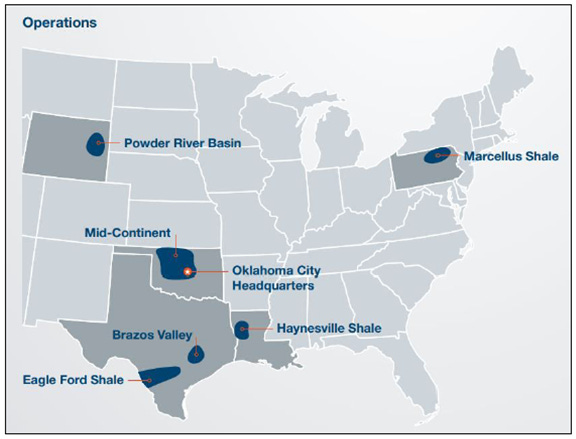

Chesapeake’s Operations:

“the Debtors held (i) interests in approximately 13,700 gross wells, a substantial majority of which are Debtor-operated, (ii) approximately 5,193,000 gross acres of developed leasehold, undeveloped leasehold, & fee minerals, in the aggregate, and (iii) estimated proved reserves of approximately 988MM” Docket 49 (p.12)

And yet, Chesapeake still drilled…

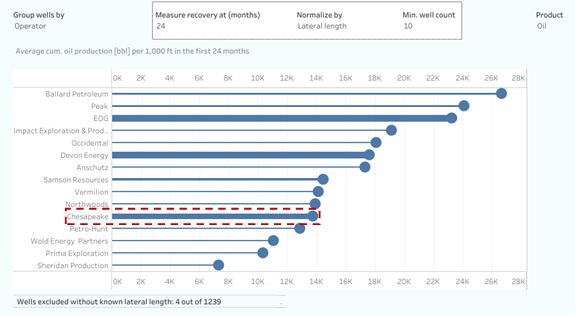

From ShaleProfile, message Enno & start a trial

Did the Powder River Basin wells (ever) make a true return?

…

Why were the wells drilled?

Ask yourself two questions, & you tell us:

Did management get paid on the way down?

Did management get paid ahead of Ch.11?

Management incentives that reward financial destruction can & do manifest situations where irrational competitors enter an industry & eviscerate the economics for everyone.

When Enron’s auditor won’t sign off…

When Rolling Stone describes shale economics more accurately than executives…

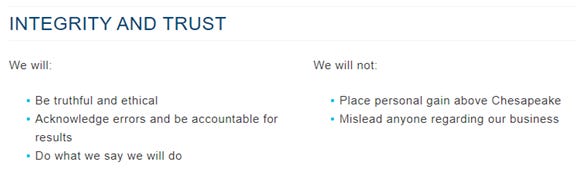

When Chesapeake lists their 1st core value as…

…in the face of pages of Material Litigation (Docket 49, pp. 29-32) in practice.

We can go on. And on.

The shamelessness has no end.

There’s an argument to be made that Chesapeake spent years negotiating with creditors & paying down debt in good faith.

But in the face of the rest of the evidence, the story is simple -

Chesapeake’s management spent years paying themselves a fortune, while ship they captained slowly sank -

OTHER NEWS.

Last week, Rachel Adams-Heard published an article on Oil Reserves, mentioning our bit on Ring’s RBL [thanks for the look]. We recommend the read.

After digging into Chesapeake, it’s clear that there are company-level governance issues that go well beyond reserve financing issues…

WoodMac Chesapeake Call (11AM EST)

Big payday for restructuring advisors

Lilis Energy files for Ch.11

We’re taking Friday off - catch y’all next week - be safe & enjoy the holiday weekend -